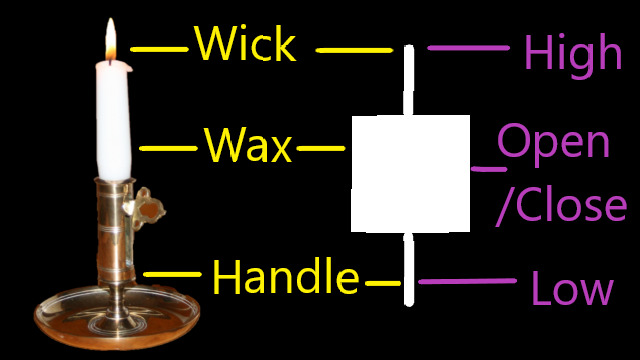

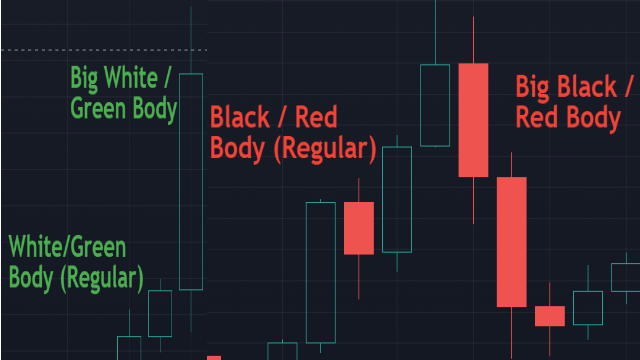

Simplest PatternCandle Body Length

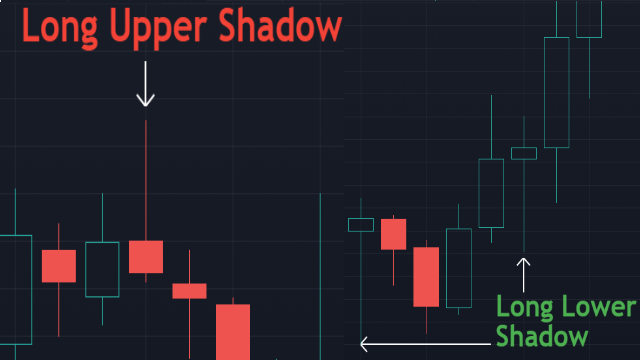

Candle Shadow Length

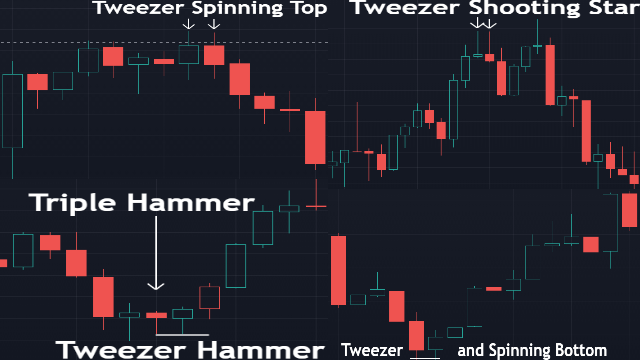

Simple PatternsHammer

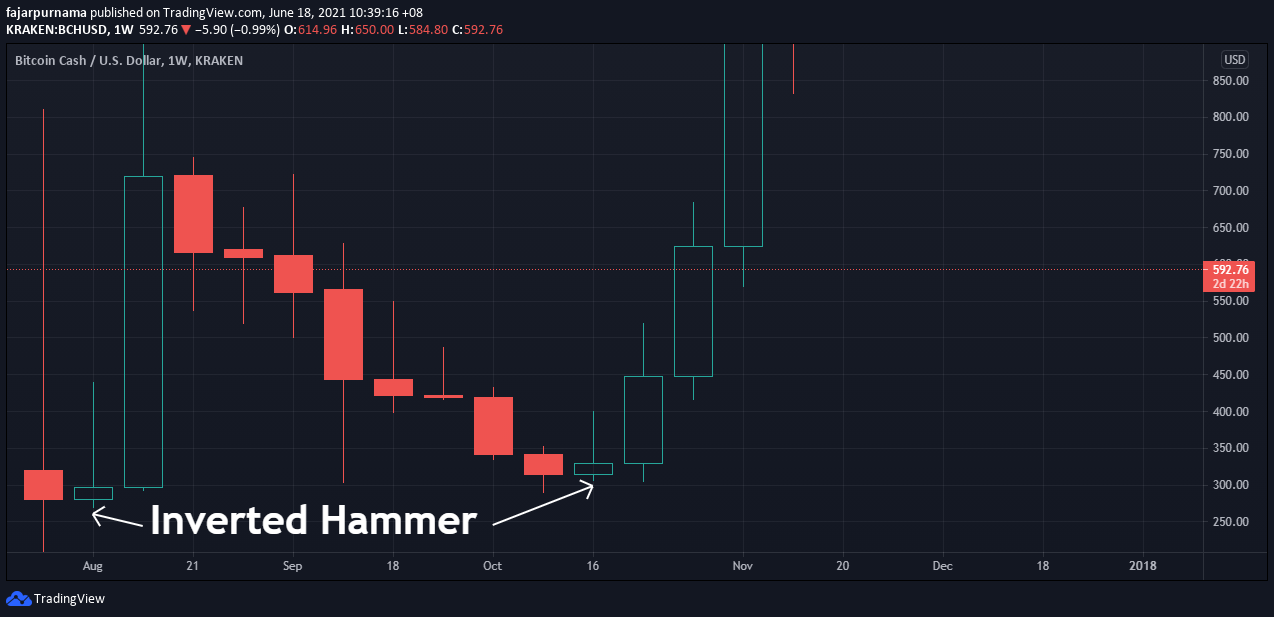

Inverted Hammer

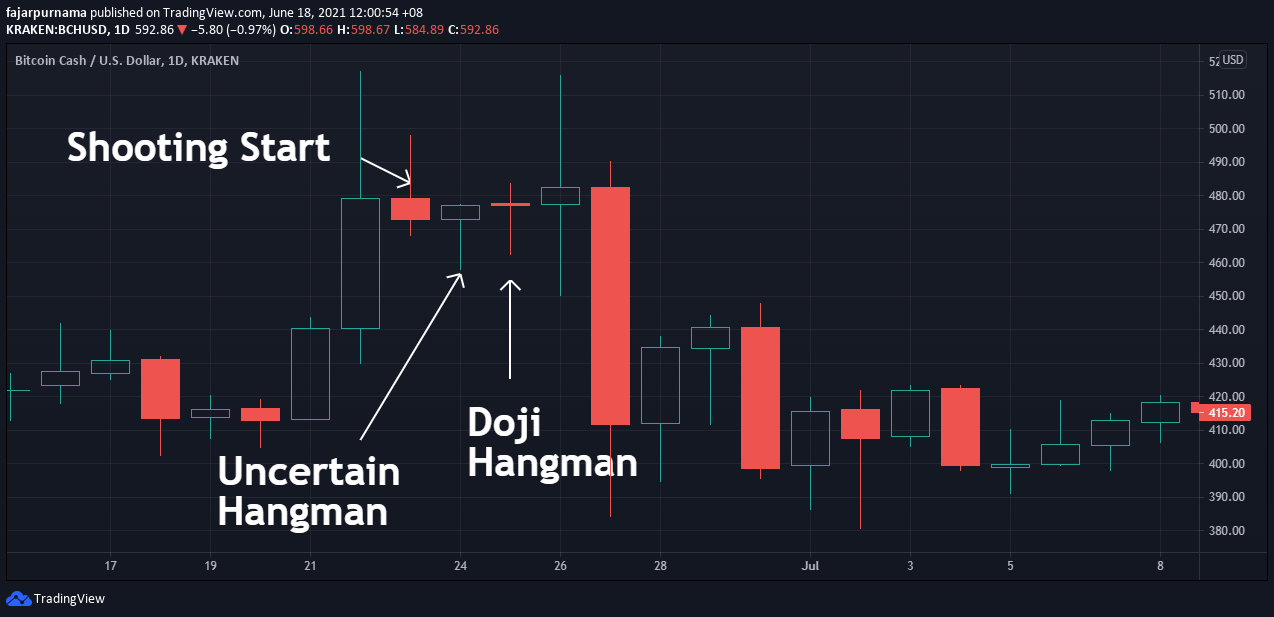

Hanging Man

Shooting Star

Marubozu

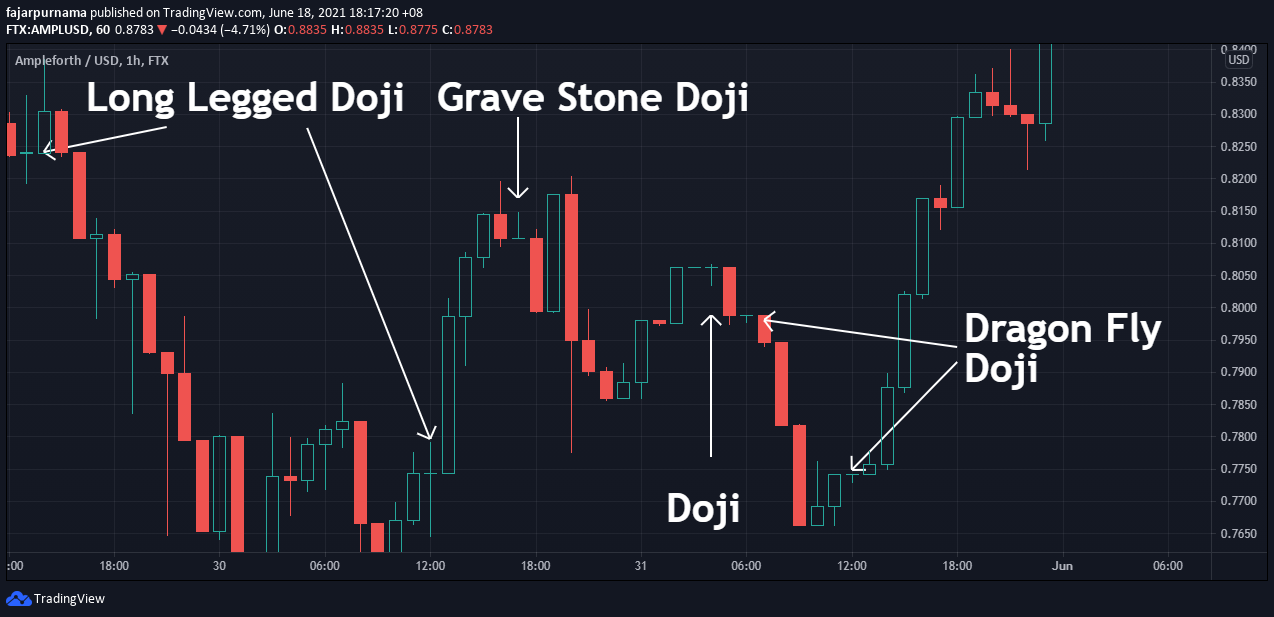

Doji

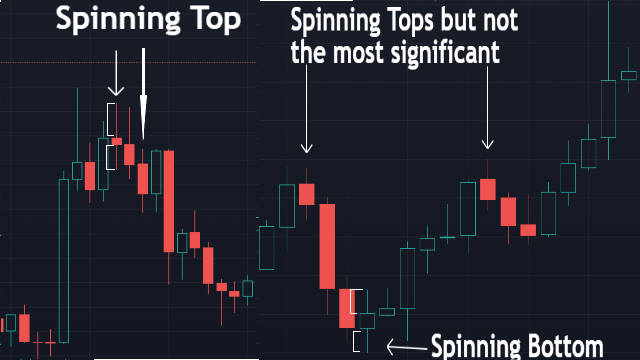

Spinning Top and Spinning Bottom

Popular Complex PatternsTweezer

3 White Soldiers and 3 Black Crows

Harami

Engulfing

Judas

Stars

3 Inside and 3 Outside

3 Line Strike

3 Method Formation

Wait

0 Comments

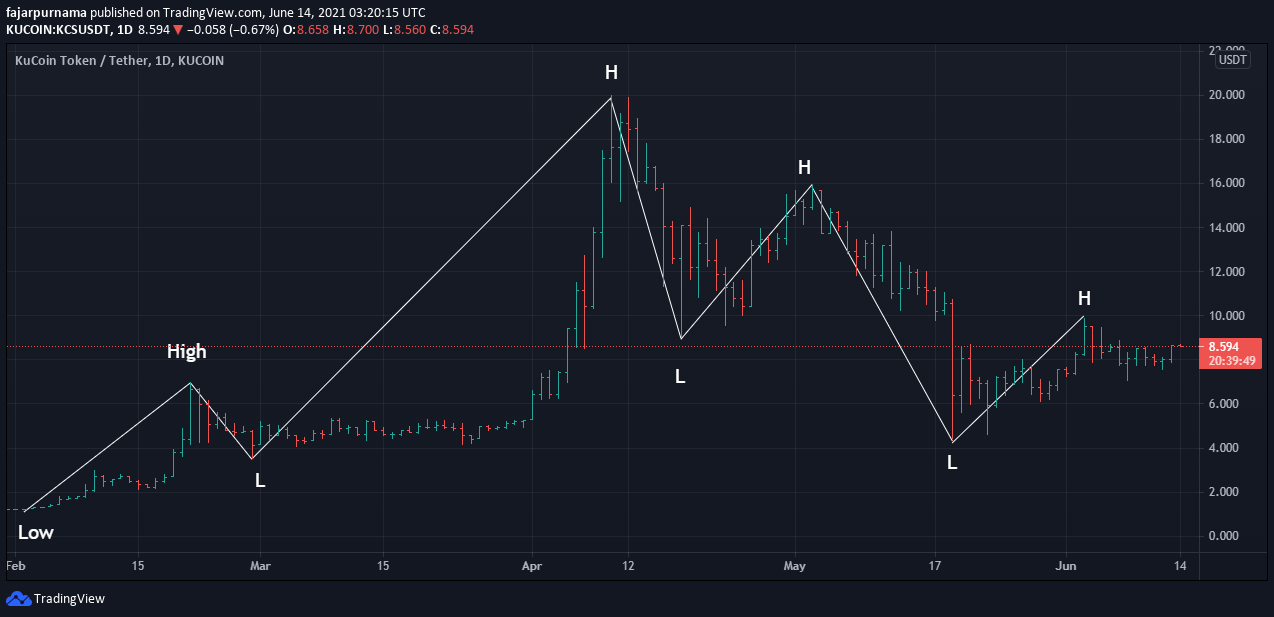

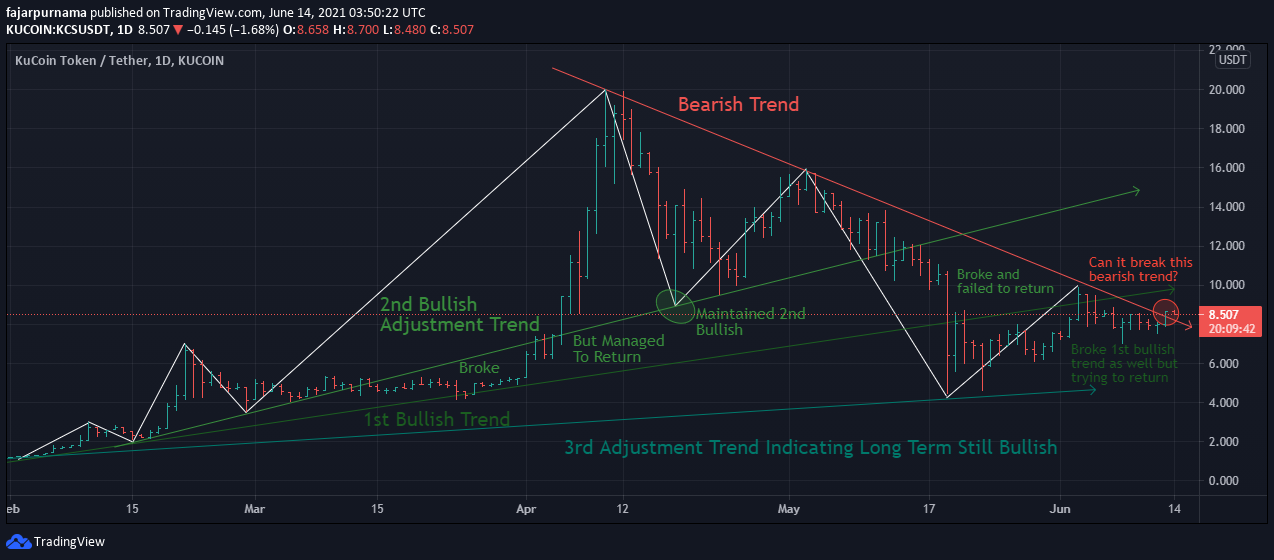

Swing

Trend

Cryptocurrency believers and supporters often Dollar Cost Average (DCA) or buy small amounts every certain periods like an installment. It is a good idea to do this whenever the price touches the trend line. Not only it is much better than buying at the top but buying whenever the price touches the trend line helps maintains the bullish trend which should be inline with the goal of believers and supporters. If a clear trend break occurs, it is better to wait and DCA in the next lower bullish trend line. Support and Resistance

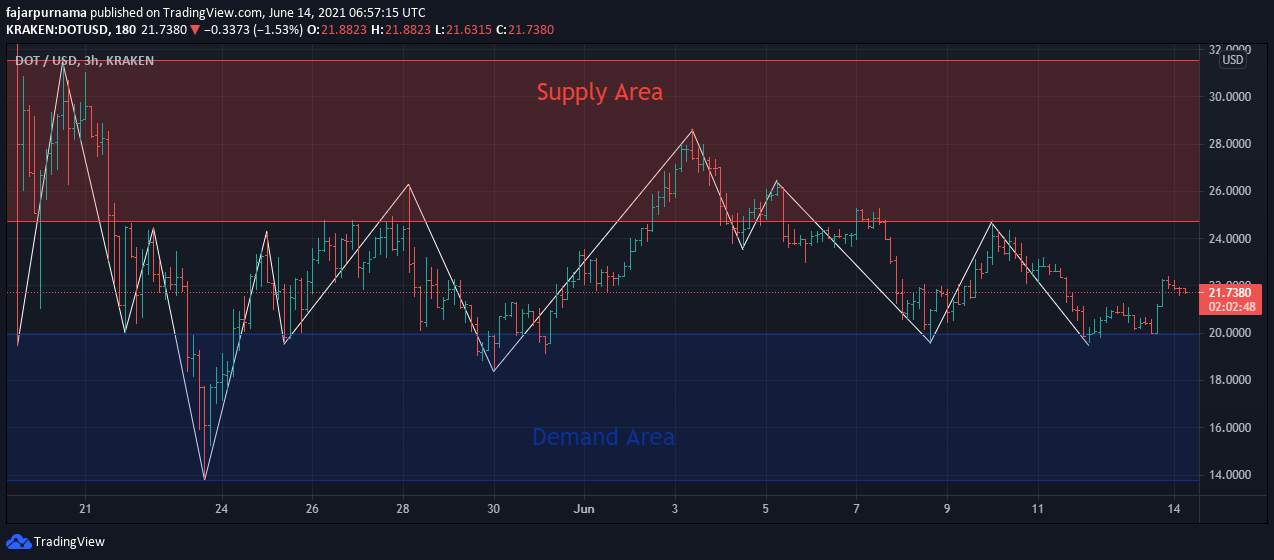

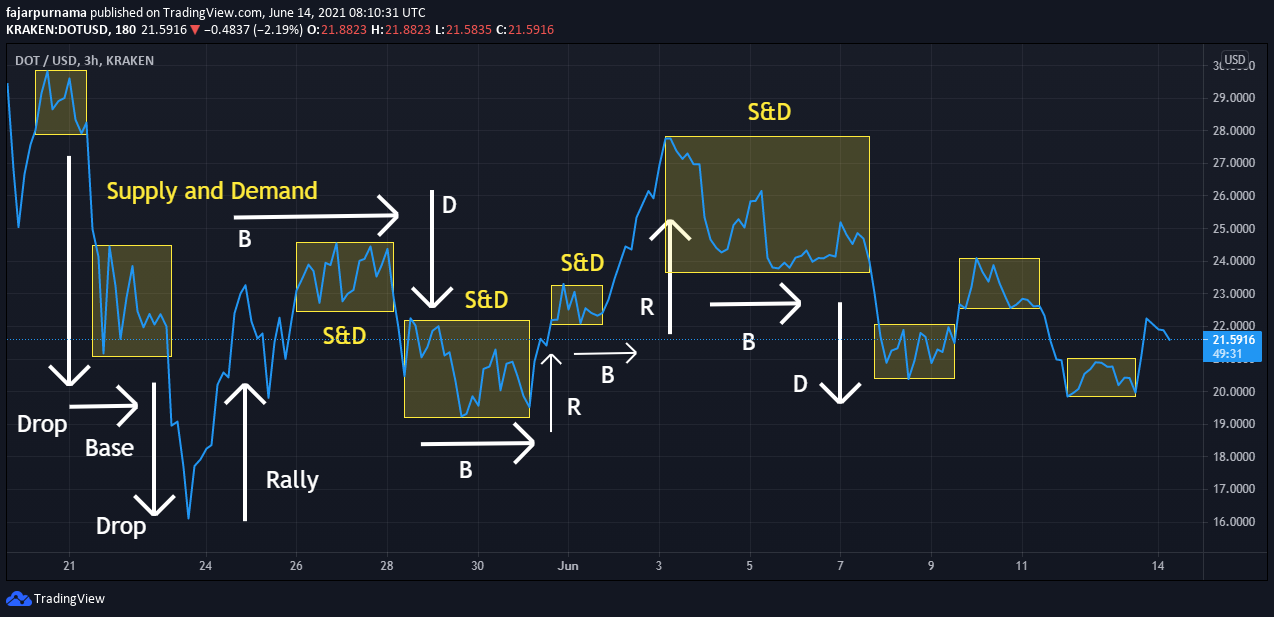

The first support line to draw is the lowest price action in the current visible chart and vice versa for the first resistance line which is the highest price action. For me, I like to draw another support line at the second lowest sharp downward spike and vice versa for another resistance line the second highest mountain. Last is to draw significant support and resistance lines. The more often the price bounces the more significant the support line and the more often the price rejects the more significant the resistance line. For cryptocurrency believers and supporters, the next line to DCA is the support line when the trend breaks. For traders is a chance to buy big because the price oftens bounce big for a short time which is a chance to win short term profit. If going big, make sure to stop loss when the price breaks down the support line because there will be high probability that the price will continue to drop. For beginners, the resistance line is not a good place to hurry and buy. It is best to analyze first whether it can break the resistance line or not. If not, wait for some bullish news and breaks to be safe. Supply and Demand

ReminderAfter learning swings, trends, support & resistance, and supply & demand, most of us are probably eager to try trading straight away but do not forget that if we trade based on this alone, we are only using technical analysis which there more factors to consider. One of the DOW Theory tells us to always confirm the market where when we finish drawing technical analysis, do not forget to confirm with the news etc. Also, another DOW Theory to not forget to look at the bigger picture first. Once again, this method can be applied anywhere such as commodities, stocks, and foreign exchanges. For crypto supporters, why do we need need this method if we can just buy at every dip or dollar cost average (DCA) every month? This method can improve our buying timing where we can accumulate more crypto than just randomly buying.

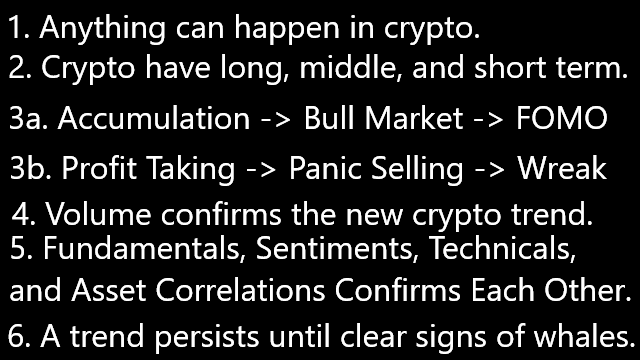

In the current financial technical analysis (FTA), the first subject to learn is the DOW Theory. Sounds similar to DOW Jones right? Well it was written by Charles H. Dow who was the co-founder of Dow Jones and Company. The writer himself never called it the "DOW Theory" as he was just writing pieces of information in The Wall Street Journal where he was the founder in. William Peter Hamilton, Robert Rhea, and E. George Schaefer collected and organized his writings from 255 editorials in The Wall Street Journal and called it the DOW Theory. If you have been following my blogging income reports, you probably read that I used my profits from the crypto bull market to take a course in financial technical analysis. Since there are already many sources about the Dow Theory such as Wikipedia and Investopedia, I will write mine from a different perspective which are based on my experiences in the cryptocurrency market and my financial technical analysis course. There are six main headlines of the DOW Theory: 1. The Market Discounts EverythingThe market incorporates every single piece of information in real-time. It is almost humanely impossible to catch up in real-time. So there are "no absolutely right" and "no absolutely wrong", but there are "most likely" and "less likely".

To relate this to crypto it is always best to quickly change our tune. An investor does not follow Bitcoin Maximalist who are always bullish in Bitcoin. Always bullish is good for early investors but for new investors, it is stupid to buy at a high price. It is safer to wait for a pull back, correction, or the bear market rather than buying high and panic selling later. Investors must realize that they are not purely investors, they are supporters who will live and die for Bitcoin. For analyzers, the market is the king, not Bitcoin. If you want to take a god, do not take Bitcoin as a god, but take the market as the god. On the other side, always bearish like Peter Schiff and listening to central bankers always saying that crypto have no value and pure speculations is not good either. I do believe that the crypto market is highly speculative as most people went in only to hope for profit in the future. However, only "highly" and I believe there are values such cheaper cross border transaction, transparent ledger, cannot be confiscated, cannot be censored, decentralized finance, and all other innovations in financial technology (fintech). When Bitcoin reached $1000, Peter Schiff was right to call it a bubble, but when it dropped, it was not wise to stay bearish. The fact that it went up to $20000, he was right again to call it a top and dropped to $3000 but do you stay bearish again? Wrong! the next top is $60000! Following Peter Schiff is good for preserving your wealth by converting your assets to gold and silver but for average people will never break through the rich boundaries if you just follow him. If you ignored him and went in to crypto early, you have been rich. Even I earned 10 years worth of average salaries in just half a year. If you are a trader and always listens to Bitcoin Maxis or Peter Schiff, you should stop calling yourself a trader. 2. The Chart Have 3 Main ScalesMicro Scale

Macro Scale

Full Scale

Order of AnalysisI wrote the narrative the opposite of how we supposed to analyze in order to emphasize the importance of looking at the bigger picture. Not looking at the bigger picture is also the cause of people getting destroyed by fear of missing out (FOMO). When looking at the bigger picture, people should be cautious when Bitcoin pumps, but instead did not take profit and let greed took over them, resulted in them panic selling when the price crashed. Ofcourse, they will cry more when the price recovers. Although the best time to trade is during the FOMO but the best time to invest is during the calm before the storm and by zooming out to the bigger picture, we can better guess when it is a calm and when it is a storm. Looking at the bigger picture applies every where not just in finance. When we want to read a book, we first look at the cover, the title, then its summary before reading the contents. In an article, we read the headings first, then the images, then finally the contents. In education, we learn the overview in primary school and highschool, then choose a field in undergraduate school, and finally specialized in graduate school. We ourselves are living in a world, in a planet called Earth, Earth have many countries, countries have many provinces, and provinces have many cities. There are numerous examples and the order for financial technical analysis is:

3. Each Scale have 3 Trends and 2 Trends have 3 PhasesThe 3 Trends

The 3 Phases in 2 Trends

Bullish Trend

Bearish Trend

4. Volume Confirms The Trend

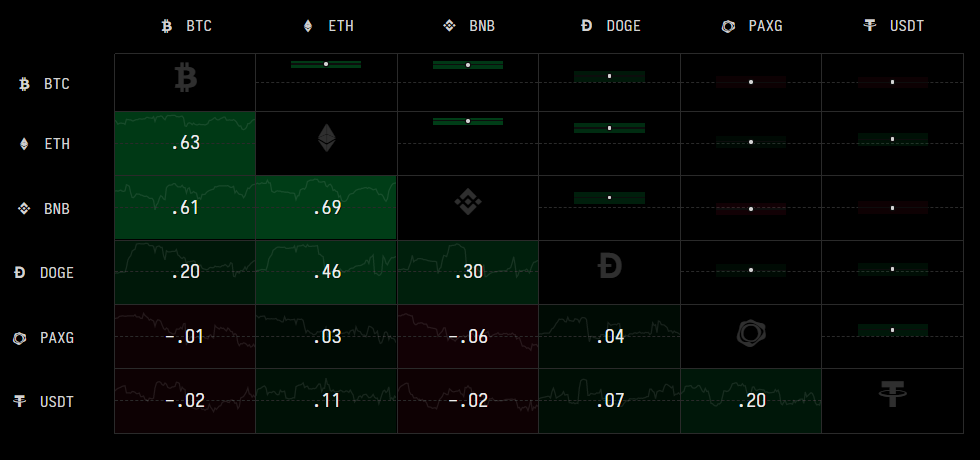

5. Market Confirms Each Other

Here I am using Crypto Watch to see correlations between crypto assets. It is popular today when Bitcoin is up, the whole crypto market is up, and so does the reverse. Although, I find it safer to use the top coins as an indicator or better of the majority of the market if possible. If the top coins goes down, there is a high possibility that other coins will follow. If you are eyeing on a coin, it is better to wait until it goes down as well before buying. On the other hand, if the coin you are eyeing does not go down, it tends to go up instead where bases on my experience, something special is happening with the coin. In my opinion, one the reason why the whole crypto market is correlated to Bitcoin when the price rises is because there are still many people who are not into crypto. For new people, Bitcoin is the first thing they learn. It is very rare for someone new to know about random coin first before Bitcoin. After they are into Bitcoin, then they will see that there are other cryptocurrencies. In short, Bitcoin is currently the corner stone for new people. They buy Bitcoin first, then they buy other coins which is why when Bitcoin rises, other coins tends to rise. As for when Bitcoin price is down, is related with everyone trying to buy top coins with cheaper price. When Bitcoin is down, traders tends to take profit on other coins and wait and see how far Bitcoin price can go down before buying. In short, most people in crypto are interested in many coins, not just one which is why when top coins goes down, people in other coins will sell as well because they see an opportunity get in more into top coins. As for token ecosystem they are the same. For UNI, LINK, and SUSHI, if Ethereum goes up, then these coins tends to go up because in order to buy those tokens we need Ethereum. For CAKE, BAKE, BANANA, etc we need BNB to buy them. For PNG, YTS, and SNOW we need AVAX. DOGE coin is becoming less correlated with the crypto market because it moves based on influencers such as the TikTok movement to make DOGE $1 and Elon Musk, Snoop Dog, Gene Simons, and Dallas Mavericks adopting DOGE. Gold and Silver is becoming less correlated both to the US Dollar and the crypto market which is a good diversification option. Finally, there is no such thing as buying crypto and US Dollar at the same time as they are negatively correlated. Other than correlating one indice with another and one asset with another, is to correlate information in our analysis. When our technical analysis shown to be bullish and a buy signal, we should confirm with the fundamentals whether the project delivers good product or not, the road map whether they deliver on time or not, the news whether it is interesting or not, and the sentiment whether people are happy or angry. If most of them are positive, then is a strong convergence correlation that it is mostly safe to buy. However, if they are negative which is in divergence, there is a chance of reversal so be careful where it is best to do nothing if we are not sure. For example, the news is bullish but the price does not move. Investors will get disappointed and will sell. 6. Trend Persist Until Clear Reversal

RecommendationThe DOW Theory is helpful everywhere, not just stocks, cryptos, and foreign exchanges. It is helpful even in commodities, business, and for merchants. New traders probably did not know there is the DOW Theory and went straight to identifying supports and resistances, and drawing trend lines. A serious financial technical analyzer memorizes the DOW Theory, understands the meaning behind, and always be mindful of the Theory in every analysis. In other words, DOW Theory is first before doing any kind of drawings. For example, look at the bigger picture first and guess the phase that we are in. Second, check whether the trend is persisting or not and see whether the volume confirms so. Third, do not forget to look at the news, check people's sentiments, and see other correlated information as well. For example, we do not want to be buy/long on gold and Bitcoin when the United States Dollar is recovering. Instead, it is better to long on US stocks. Even before that, the fundamentals is more important where at least we should know what we are investing or trading in. You can try asking new traders about what Ethereum, Binance Smart Chain, and Polygon is. Probably most of them cannot answer. If they can, the answer is most likely that MATIC greatly rose and they made profit buying MATIC. If you are that kind of people, that is find, it takes time to read the fundamentals and you may most likely miss the trading if you read the fundamentals first. However, do not be like that forever because it increases the chance of you getting wreak. When you are asked what MATIC is, at least you should answer that it is a second layer of Ethereum providing much cheaper fees for decentralized finance (DeFi). That is a much better answer even it is not too accurate. Finally, when the market goes the opposite of your prediction, do not blame the market because DOW Theory number 1 that the market discounts everything and probably you missed some information. It is your analysis that is wrong, not the market. Discounts "everything" is literally "everything", even Elon Musk's Tweet. Content CreationBlogs

Videos

Images

Personal Monetization

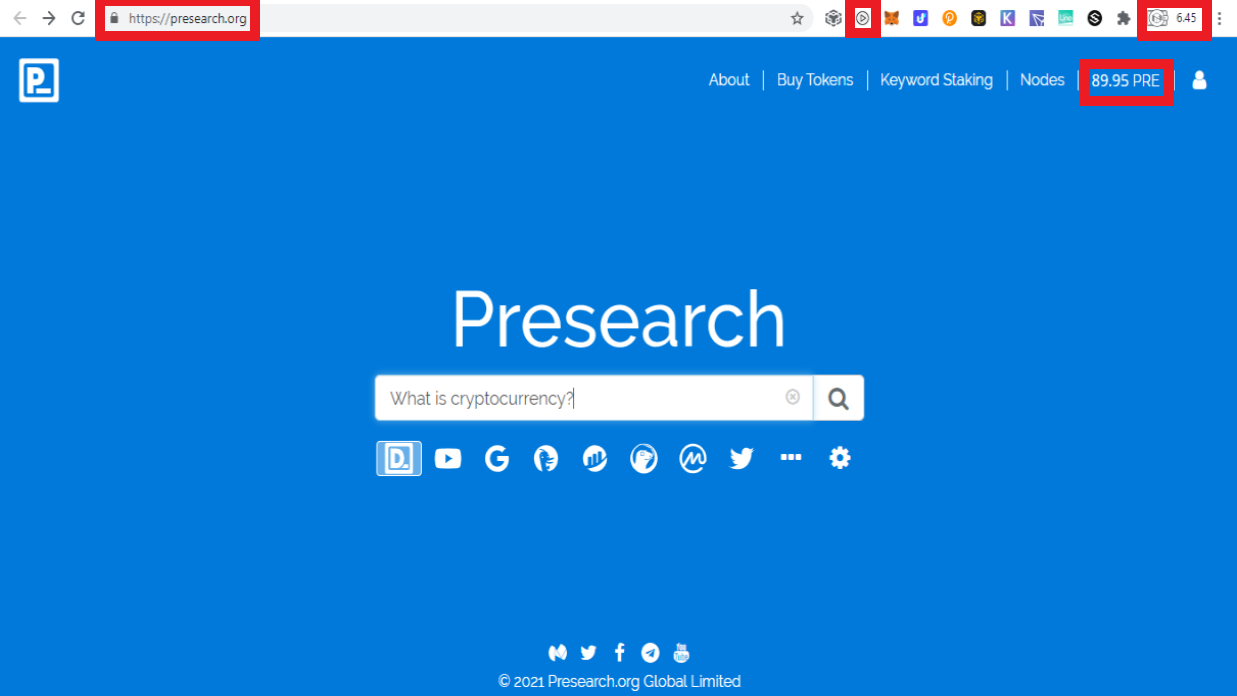

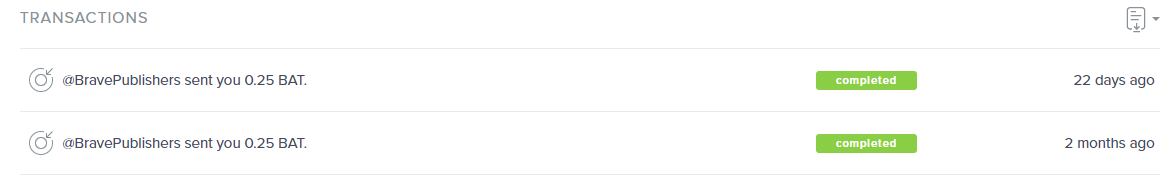

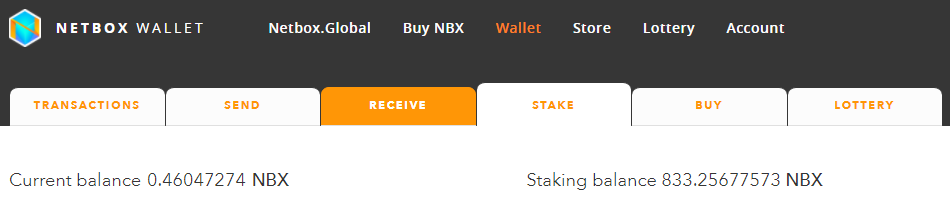

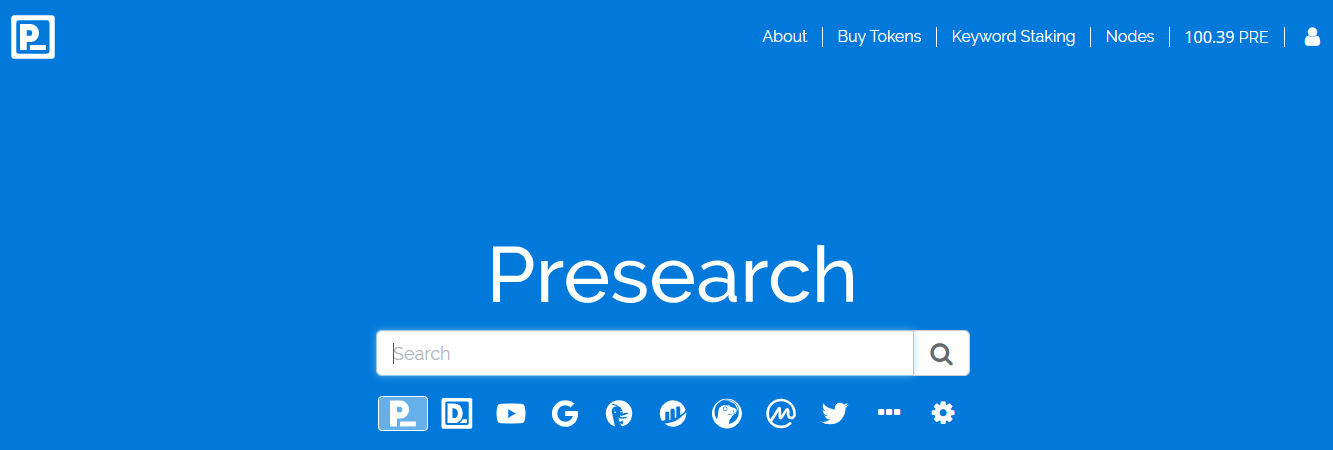

Common TasksBrowsing

Cointiply

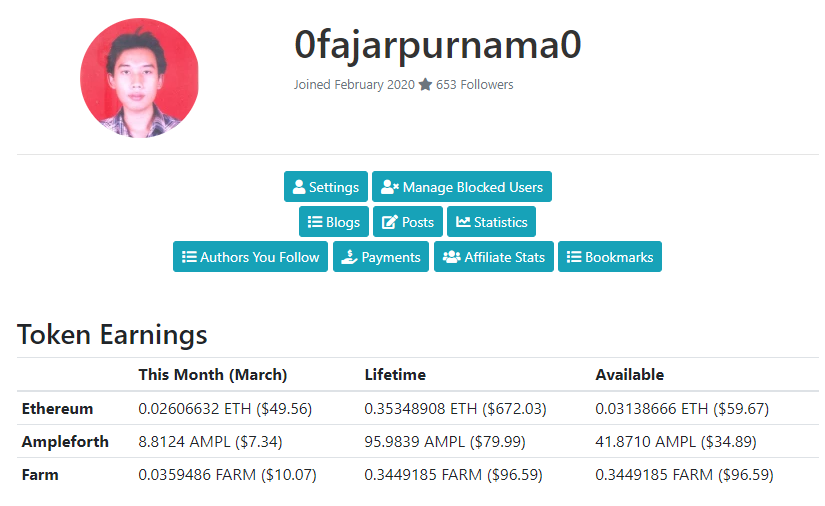

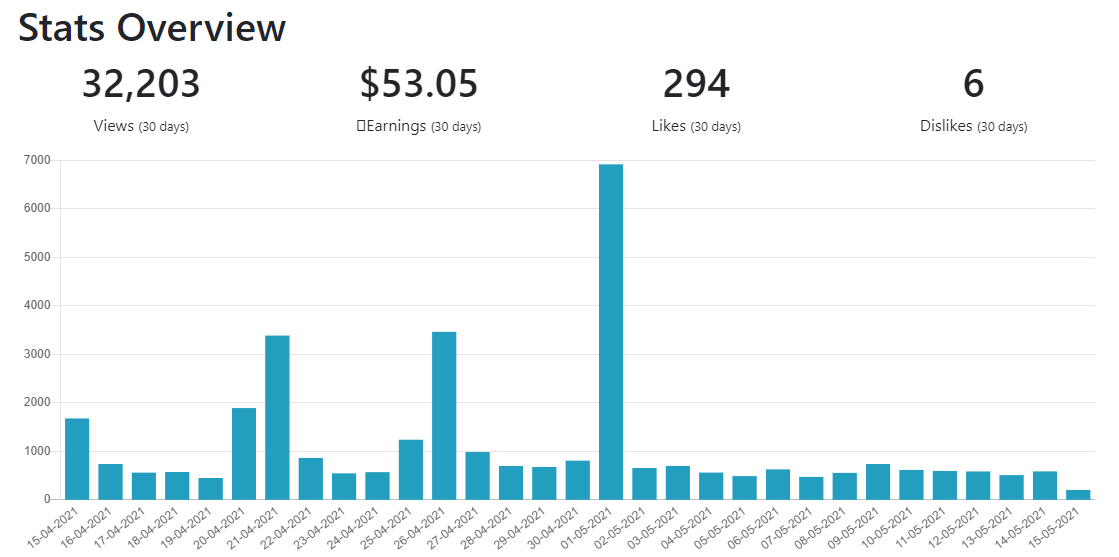

ReferralsCurrently the quantity is too much to handle when the value I earned is not much. So I may report this on a separate article. May 2021 Income ≈ $45Grade: DPersonal CommentsThanks to Elon Musk, China, and many other factors, May was the next big market crash of crypto. I lost 1/3 of my profits which was 10 years worth of average salaries here. I gave and donated another 1/3 before the market crash to people important to me. I am now left with 10 years worth of average salaries. I did sense that the market was going to crash but I missed it anyway because the fundamentals are in divergence. The fundamentals are still upcoming for innovations such as ETH 2.0, Binance NFT market place, Polygon (MATIC) as alternative to current expensive Ethereum, Polkadot cross chain, synchronization between Harmony One's main net to its smart chain where no need to cross chain like BEP2 BNB to BEP20 BSC and AVAX main net to its C Chain, etc. Therefore, I used some of my profits to take a private course on financial technical analysis. However, the reason why I completely did not blog for an entire month was because many friends contacted me since my parents exposed my big profits during the bull market wanting to start trading crypto as well. As I wrote, I gave my parents some of the 1/3 of my profit and became curious about trading and used them to trade instead. I spent most of my days receiving guests helping them opening accounts at local cryptocurrency exchanges, deposit, and start trading. Ofcourse I knew that most of them do not care about crypto but only the getting rich quick. After teaching them the technicalities, I immediately told each of the groups to make chat groups where trading together is more fun and less stressful while avoiding myself temporarily being a signal provider. Each of them shared in their groups what they wanted to buy and what they wanted to sell. If profit then we celebrate together, if loss then we mourn together. They wanted me in the group to provide signals for day trading but unfortunately they overestimated me. I am a gem hunter, not a trader, not even an investor is accurate. To follow me gem hunting is currently too difficult for them. Therefore, I remained my role as an educator and gave descriptions about different coins daily for example Bitcoin is ..., Ethereum is ..., Litecoin is ..., USDT is ..., in order for them to at least know what they are investing in. This is also one of my reasons to take a course in financial technical analysis so that I can give signals to them too. Still, they are happy because during this COVID-19 Pandemic that they have the opportunity to earn at home rather than being pessimistic doing something unproductive everyday. I actually planned to become an educator for users but it came earlier than I expected as my original plan was to complete my materials first while blogging. However, it is this enthusiast that made me forget Andreas Antonopoulos words that went our distant friends and families suddenly contacted us asking about crypto is went we should sell everything because that is a strong indication that the market is in excessive greed. Well, I missed selling and I am still hodling until now but my goal remained the same which is to introduce crypto to more people. Think about it, all my peers in college, I can count using my fingers who actually know about crypto. What happen if almost everybody know about crypto and it becomes main stream, how far can our portfolio rise? Still few people know about crypto, so if we missed the panic selling, is better to hodl because we are still early. Only if you entered the crypto market when it is already main stream is when you should be worried. Appendix

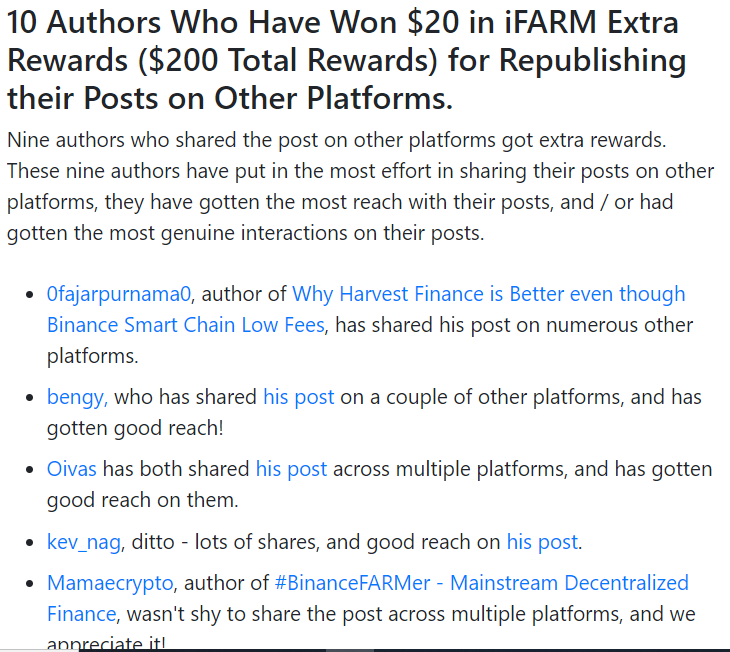

DonationPersonally, I enjoyed being a full time independent content creator very much and I once again thank the platforms, investors, donators, and viewers for making my venture possible through donations, tippings, and upvotes. If you enjoy and/or want to further support my work you may choose more form of donation:

Mirror

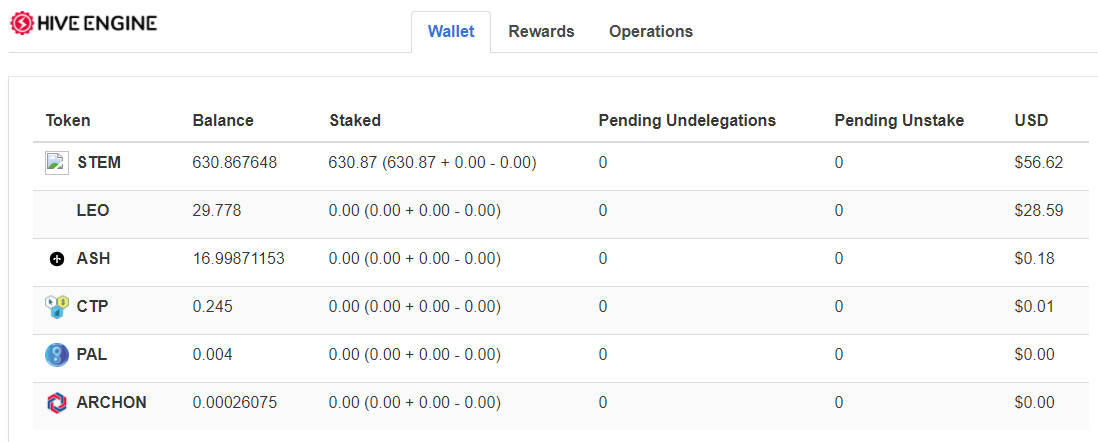

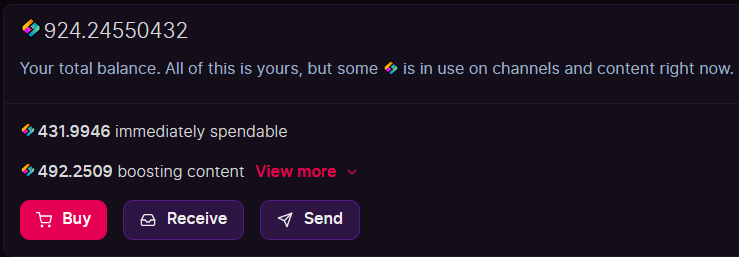

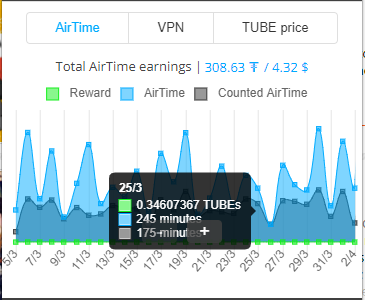

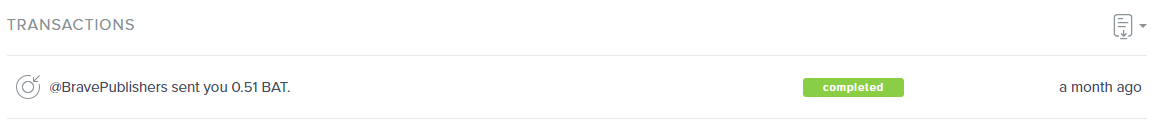

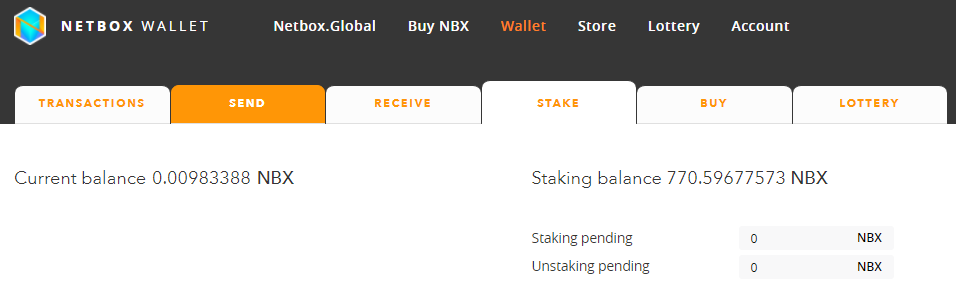

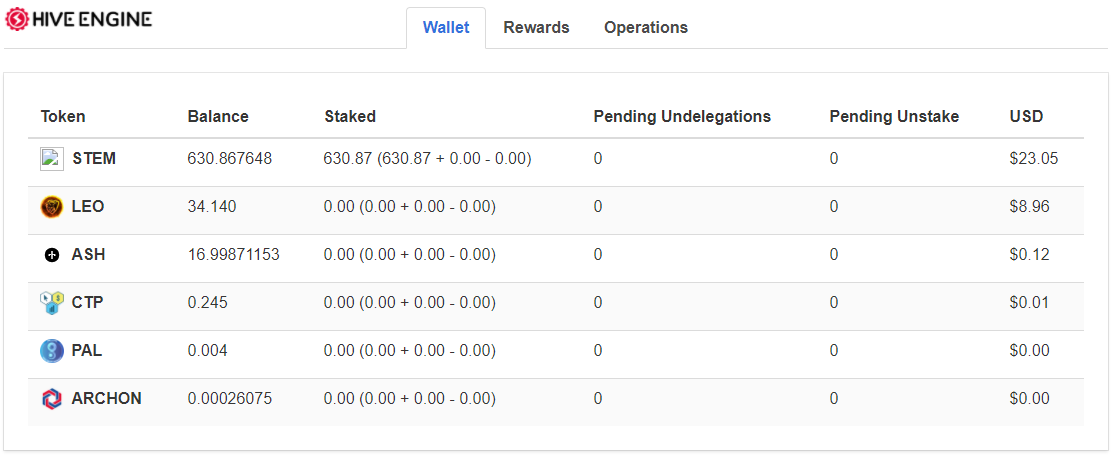

Content CreationBlogs

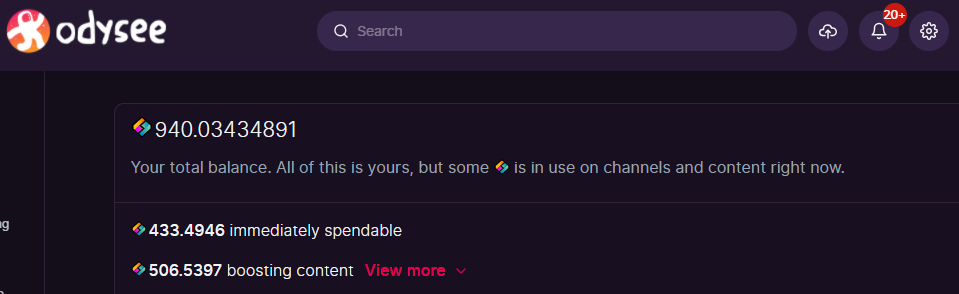

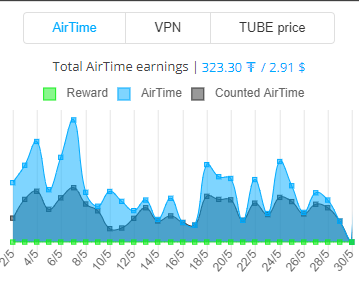

Videos

Images

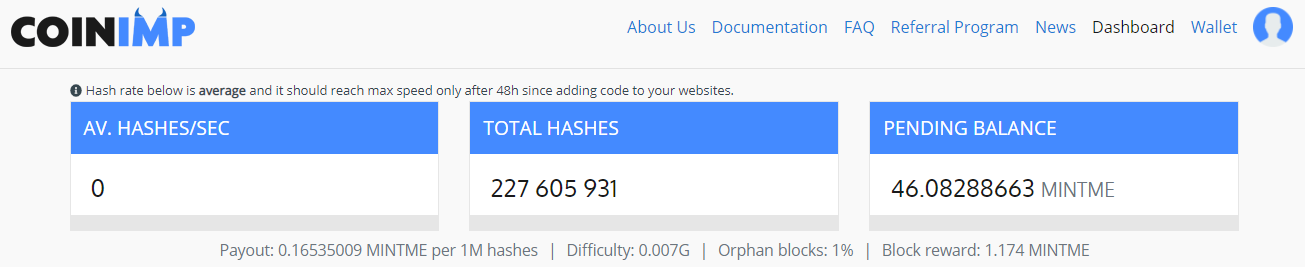

Personal Monetization

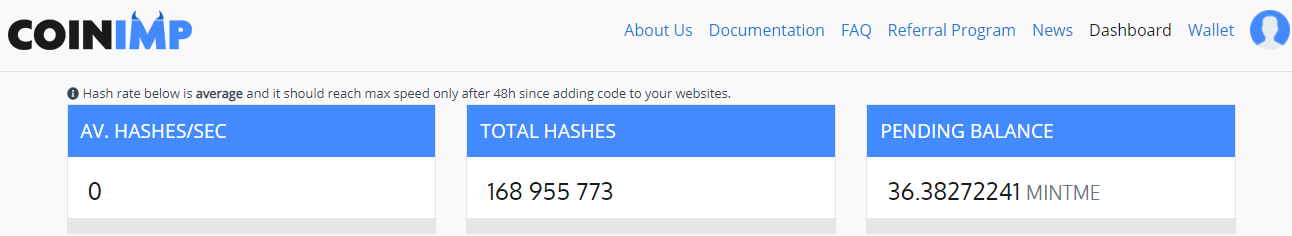

Common TasksBrowsing

Cointiply

ReferralsThis month also I received many Netbox referral rewards unlike other months which are purely activities so thanks for using my link! Currently the quantity is too much to handle when the value I earned is not much. So I may report this on a separate article. April 2021 Income ≈ $61.73Grade: DPersonal CommentsApril was the middle of the bull market and I decided to stop blogging and chase the profits. Although most of you will see it as either trading or investing, I like to call it gem hunting. Maybe you see me as FOMOing (fear of missing out) just like the others, but I did it differently than other FOMOes. I was weak in technical analysis. I can only do fundamental analysis and check the news. FOMOing in BTC, ETH, BNB, MATIC, DOT, DOGE, SHIBA INU etc was not something I was confident. So I spent my time looking for projects that are new, that have not pumped yet, and projects that are in massive correction. Thanks to UNI, Ampleforth Governance, ETH, DEXMEX, Polka Insure Finance, BNB, KCS, Ape Swap Banana, JDI Yield, Fairmoon, Polylastic, etc, my portfolio went up 10 times which was worth almost 30 years of average salaries here and you know what, all of these coins I sold very early where if I hold on to them longer, my portfolio would have gone another 3 times. These gains were worth temporary stopping my bloggings for a while. Appendix

DonationPersonally, I enjoyed being a full time independent content creator very much and I once again thank the platforms, investors, donators, and viewers for making my venture possible through donations, tippings, and upvotes. If you enjoy and/or want to further support my work you may choose more form of donation:

Mirror

|

Archives

August 2022

Categories

All

source code

old source code Get any amount of 0FP0EXP tokens to stop automatic JavaScript Mining or get 10 0FP0EXP tokens to remove this completely. get 30 0FP0EXP Token to remove this paypal donation. get 20 0FP0EXP Token to remove my personal ADS. Get 50 0FP0EXP Token to remove my NFTS advertisements! |

RSS Feed

RSS Feed