Australian Dollar / Canadian Dollar (AUD/CAD)The trend is bullish but kept rejecting in the supply area and if it breaks the trend line may potentially form a head and shoulders pattern which is bearish. Australian Dollar / Swiss Franc (AUD/CHF)The overall trend is bearish while there should be some classic chart patterns but there more visible on shorter time frame. Australian Dollar / Japanese Yen (AUD/JPY)While the swings are far from ideal in showing a max bullish Gartley harmonic pattern but the possibility is always there. Australian Dollar / New Zealand Dollar (AUD/NZD)The price is nearing the demand area which can be a good idea to start looking for a long position although the classic chart pattern is descending triangle which can go either ways. Canadian Dollar / Swiss Franc (CAD/CHF)The price is really just going sideways and expect to continue in the future. Canadian Dollar / Japanese Yen (CAD/JPY)The was a clear bullish flag but the question is, is it finished? If yes, then expect short term bearish price. This estimation is supported by a potential double top and rectangle classic chart pattern. Swiss Franc / Japanese Yen (CHF/JPY)Here is an example where many traders will think that there was a head and shoulder but it did not go down either we mis analyze or the classic chart pattern really failed. As for current trend, it is sideways. I'm not sure but it looks like a rectangle pattern and the question is will it break above or not? Euro / Australian Dollar (EUR/AUD)Shorter time frame is a bearish trend but longer time frame is still bullish. There are many bullish potential classic chart patterns which are bullish flag and cup & handle. Except for rectangle that go either way. Euro / Canadian Dollar (EUR/CAD)If the price does not return above the trend line, then it can be either a trend adjustment or a reversal to bearish trend if it keeps rejecting below the trend line. I did not see it back then, but the whole chart looks like an ascending triangle classic chart pattern. I already open a short position few weeks ago and will see where it will lead. Euro / Swiss Franc (EUR/CHF)Looks like forming a head and shoulders classic chart pattern but the price is near the demand area where we should look for a long position. Maybe it will touch the bottom of demand area if a head and shoulders is really forming before bouncing. If break above, then it will not form a head and shoulders pattern. Euro / Great British Pound (EUR/GBP)The shorter time frame shows a rectangle classic chart pattern but there is a possibility that the longer time frame formed a bearish new cypher harmonic pattern although the swing is not ideal. Euro / Japanese Yen (EUR/JPY)Now this is a bearish max bat harmonic pattern that may never happen or even if it may happen then it will take many months even over a year for it to form. Euro / New Zealand Dollar (EUR/NZD)If the price continues the pattern then it may form a bearish flag classic chart pattern but ofcourse the pattern may change. Great British Pound / Australian Dollar (GBP/AUD)Like EURJPY, the max bearish Gartley harmonic pattern may never happen or even if it may happen then it will take many months even over a year for it to form. Great British Pound / Canadian Dollar (GBP/CAD)Longer time frame seems to be a descending but inside it seems to be a reverse head and shoulders formed but it can fail. Great British Pound / Swiss Franc (GBP/CHF)The price broke the bearish trend and the stochastic oscillator shows a bullish divergence. Great British Pound / Japanese Yen (GBP/JPY)Either it will break above or form a double top classic chart pattern Great British Pound / New Zealand Dollar (GBP/NZD)The trend is bullish but be careful of head and shoulders classic chart pattern. New Zealand Dollar / Canadian Dollar (NZD/CAD)Will it continue the bullish flag pattern or the rectangle pattern? New Zealand Dollar / Swiss Franc (NZD/CHF)Here's an example where a cup and handle classic chart pattern failed. New Zealand Dollar / Japanese Yen (NZD/JPY)Will it break above or form a bearish new cypher harmonic pattern? Not Financial Advice Rules

0 Comments

Major PairsMajor pairs said to be the driver of the forex market. They are the most active pairs with the highest volume. The owner of the currencies are the largest countries in the world. Very active and very high volume means that traders can enter big and exit at any time because there will always be other traders whom they can buy or sell to. Euro / United States Dollar (EUR/USD)EUR/USD is the most traded pair in all of forex. The United States is the country regarded to be the super power. The European Union have many developed countries under its banner. The very long term trend is bullish and the price seemed to return above the trend line. Aggressive traders may open a long position and stop loss as much as they can handle but ideally when it goes below the supply and demand area. If not, order a long position inside the area. Expect to take profit on the supply area but if bullish trend continues, then expect a new high. United States Dollar / Swiss Franc (USD/CHF)The Swiss Franc originated from Switzerland known for its banking and financial system so who does not know the term Swiss Bank? USD/CHF on the widest perspective seems to be going side ways for years. The bullish divergence on the stochastic oscillator seems to support the case. Aggressive traders may open a long position and take profit near the previous top. Conservative traders may open a long position on supports further below. Great British Pound / United States Dollar (GBP/USD)The Great British Pound originated from the United Kingdoms (UK) where long was Britain, the mighty British Empire that dominated the world on the previous era. Previously, there were Elliot waves and bullish gartley harmonic pattern. Currently, a double bottom is seen, and broke the current bearish trend line. However, a rejection is shown on the same pervious top forming a double top. A combination of double bottom and double top will be a rectangle pattern. Aggressive traders may want to short the pair. United States Dollar / Japanese Yen (USD/JPY)Japan is the first country in Asia to develop and rivals the west. Preveiously, a Navarro 200 harmonic pattern was spotted on USD/JPY. Currently a cup and handle classic chart pattern is forming. Aggressive traders may want to open a long position while conservative traders may order a long position on the supply and demand area. However, if a rejection occurs on the bearish trend line, then traders may want to open a short position instead. Commodity PairsSome believes that these three pairs should also be regarded as major pairs as well but they are put into commodity pairs instead. They are called commodity pairs because they originated from countries with large amounts of commodity reserves. There are other commodity pairs but this article only analyzes commodity pairs that many believes to be a major pair as well because their trading volume sometimes exceed all other major pairs. United States Dollar / Canadian Dollar (USD/CAD)Canada is in unspoiled landscape with abundant of natural resources where currently the country's largest exports are fuels and oils. The monthly chart shows a clear double top and double bottoms forming a rectangle. Trade inside the rectangle and follow the direction once the market decides to break the rectangle pattern. Australian Dollar / United States Dollar (AUD/USD)Not only Australia is the most abundant in coal and iron ore, it also exports petroleum and gold. Previously there are Elliot wave and two cups and handle pattern. The recent market also shows a potential cup and handle where traders are recommended to wait for the correction to end before entering a long position. After that, there is a bearish trend that needs to be broken where if not then traders should enter a short position. New Zealand Dollar / United States Dollar (NZD/USD)New Zealand is the world's biggest exporter of concentrated milk and also exports other dairy products, meat, wool and like Australia, gold as well. Previously, there was a cup and handle pattern and a new cypher pattern. Now there many potential patterns for the future which are bullish flag, double top, cup and handle, and max bullish gartley. Not Financial Advice Rules

Mirrors

The previous post were signals that may expire soon, while this post may take a very long time before execution or may never be executed. Again, before going live on my premium trading signal subscription at https://0fajarpurnama0.github.io/tradingsignals, I would like to practice drawing trading signals and give them for free. Monthly ChartsAustralian Dollar / Japanese Yen (AUD/JPY)

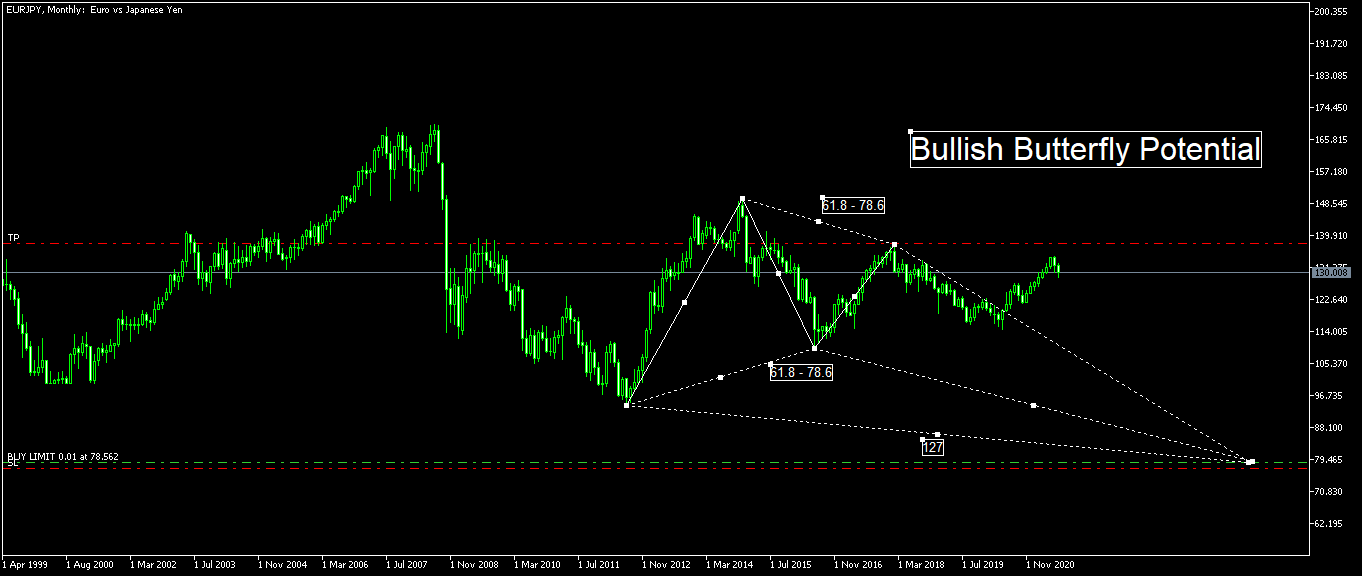

Buy Limit: 77.921 Take Profit: 87.53 can potentially further 90.57 Stop Loss: 76.575 Note: not much Euro / Japanese Yen (EUR/JPY)

Buy Limit: 78.562 Take Profit: 139.91 Stop Loss: 77 Note: not much Euro / United States Dollar (EUR/USD)

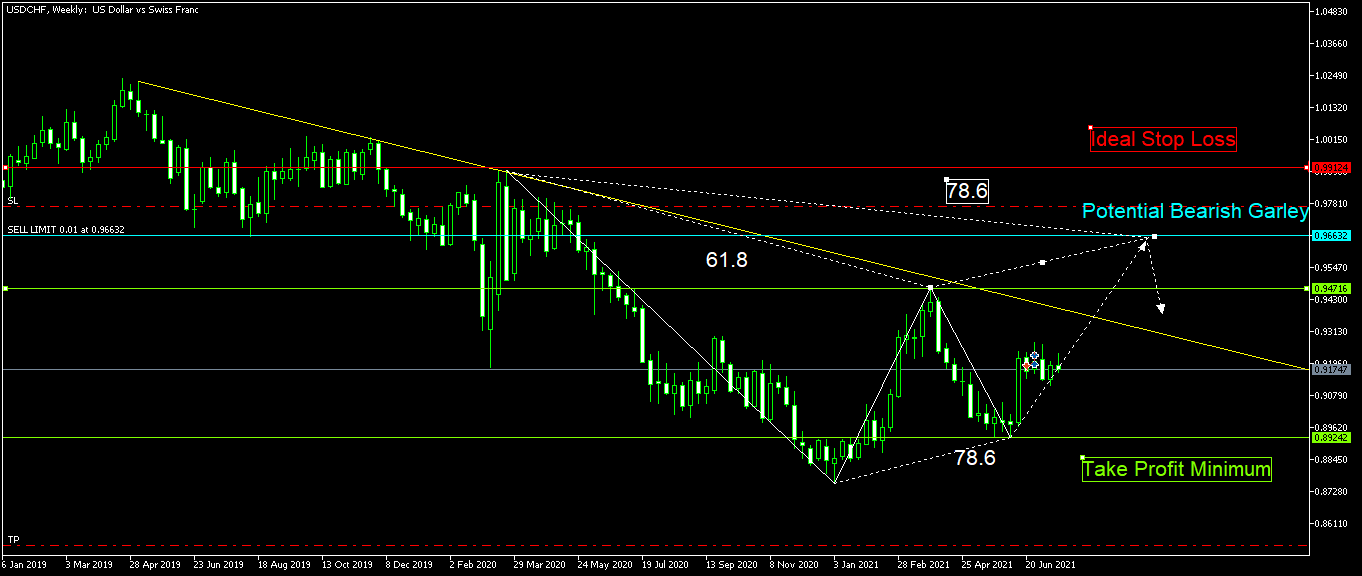

Sell Limit: 1.35649 Take Profit: 1.06192 can potentially further 0.98380, 0.8797 Stop Loss: 1.40070 Note: not much Weekly ChartsUnited States Dollar / Swiss Franc (USD/CHF)

Sell Limit: 0.96632 Take Profit: 0.94716 can potentially further 0.89242 Stop Loss: 0.9781 Note: not much Not Financial Advice Rules

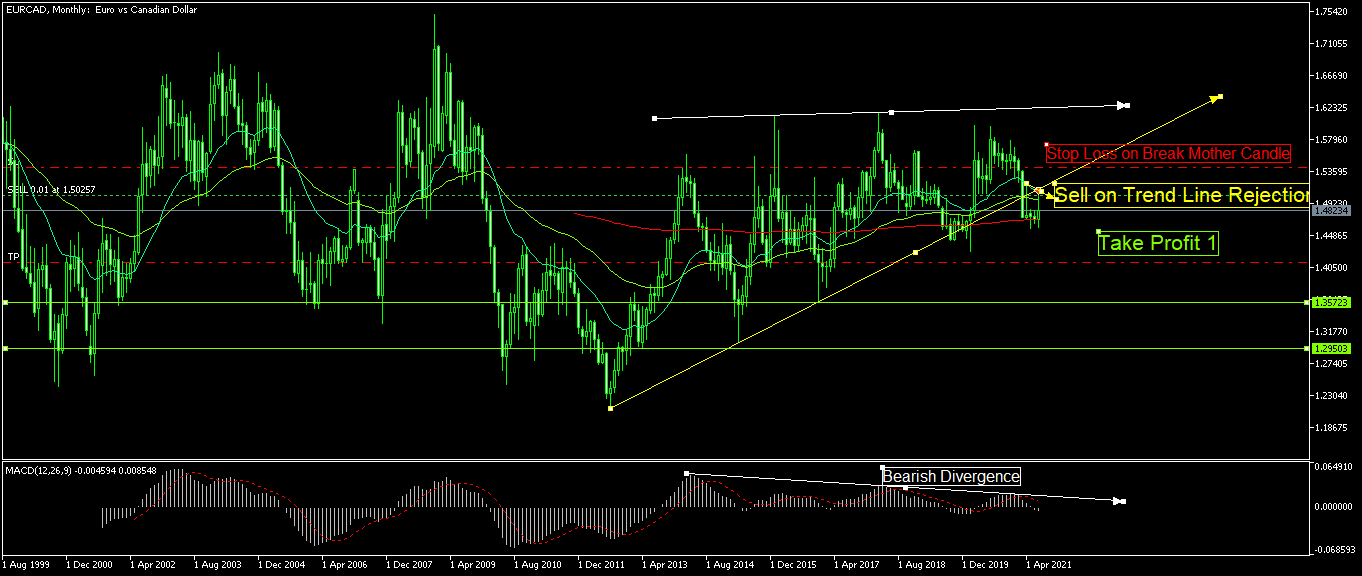

Before going live on my premium trading signal subscription at https://0fajarpurnama0.github.io/tradingsignals, I would like to practice drawing trading signals and give them for free. Monthly ChartsEuro / Canadian Dollar (EUR/CAD)

Sell Limit: 1.50257 Take Profit: 1.409 can potentially further 1.35723, 1.29503 Stop Loss: 1.54 Note: not much Weekly ChartsAustralian Dollar / Canadian Dollar (AUD/CAD)

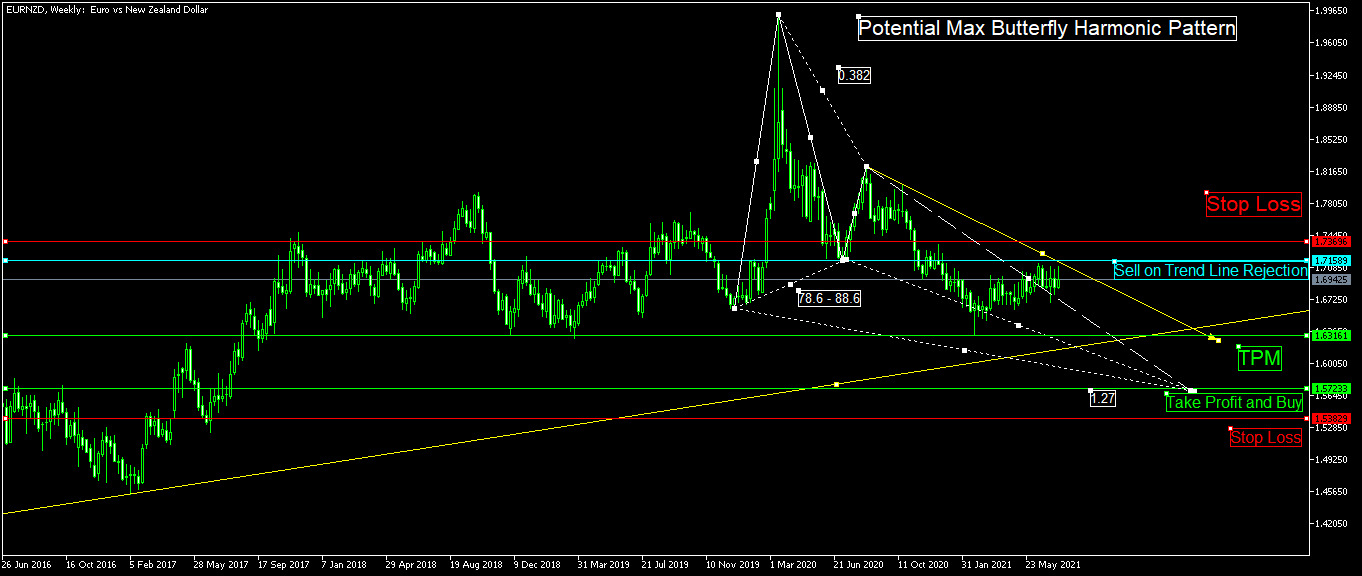

Buy Limit: 0.92363 Take Profit: 0.96653 can potentially further 0.99834, 1.03619 Stop Loss: 0.91472 Note: not much Euro / New Zealand Dollar (EUR/NZD)

Sell Limit: 1.71589 Take Profit: 1.63161 can potentially further 1.57233 Stop Loss: 1.73696 Note: buy if reaches second profit line as potential bullish max butterfly Daily ChartsEuro / Great British Pound (EUR/GBP)

Buy Limit: 0.84910 Take Profit: 0.87374 can potentially further 0.8807, 0.88419, 0.88931 Stop Loss: 0.84695 Note: not much Great British Pound / United States Dollar (GBP/USD)

Buy Limit: 1.34816 Take Profit: 1.42607 Stop Loss: 1.32645 Note: not much Great British Pound / Canadian Dollar (GBP/CAD)

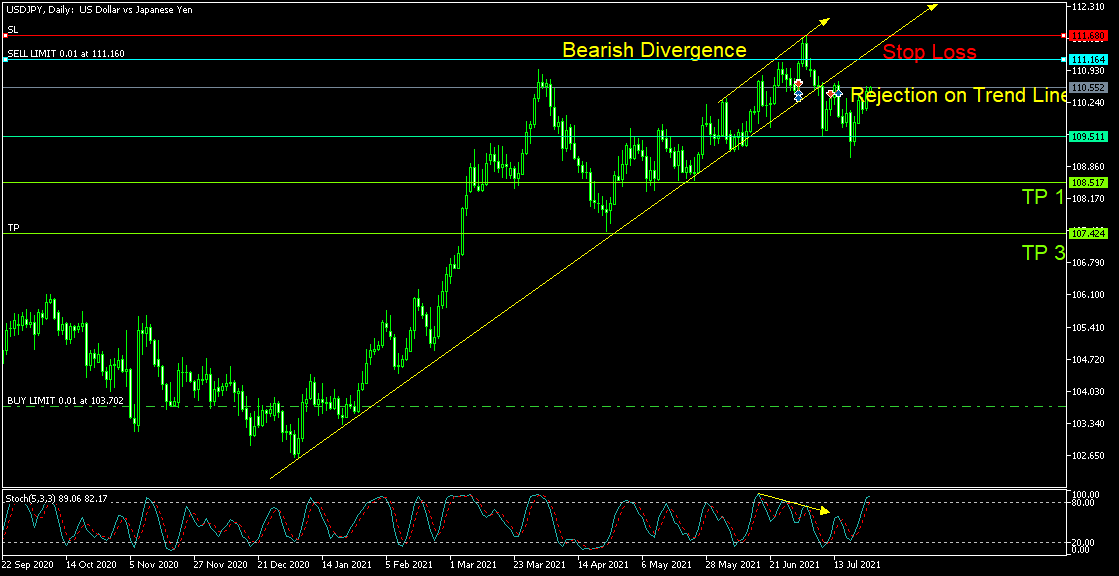

Buy Limit: 1.71692 Take Profit: 1.75922 can potentially further 1.77681 Stop Loss: 1.70964 Note: not much United States Dollar / Japanese Yen (USD/JPY)

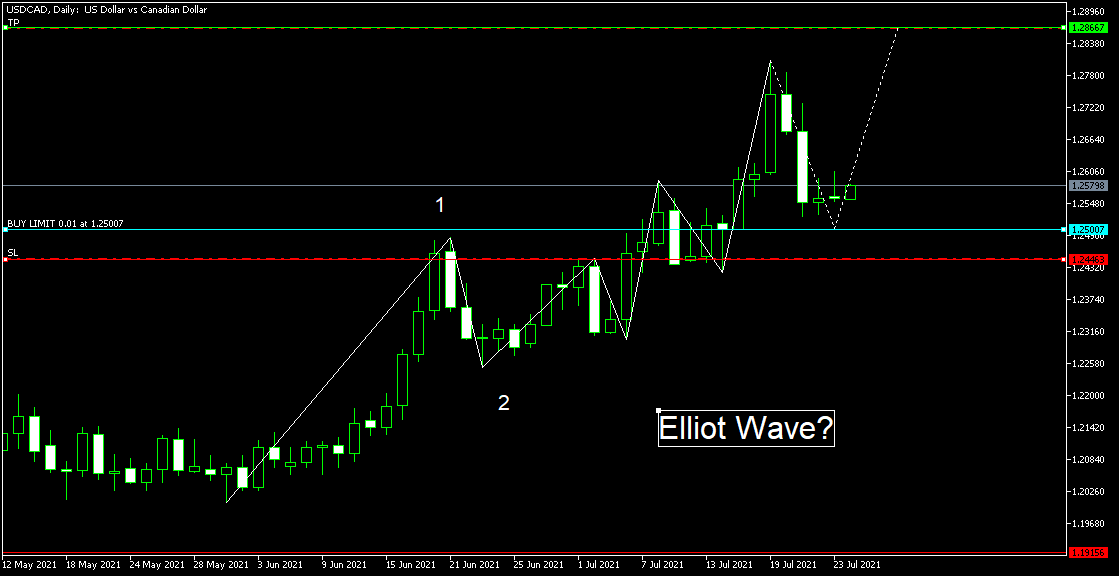

Sell Limit: 111.164 Take Profit: 109.511 can potentially further 108.517, 107.424, 103.702 Stop Loss: 111.680 Note: not much United States Dollar / Canadian Dollar (USD/CAD)

Buy Limit: 1.25007 Take Profit: 1.28667 Stop Loss: 1.24463 Note: not much Euro / Australian Dollar (EUR/AUD)

Sell: 1.60324 Take Profit: 1.58106 can potentially further 1.56111, 1.52961, 1.47693 Stop Loss: 1.61466 Note: not much Four Hour ChartsAustralian Dollar / Swiss Franc (AUD/CHF)

Sell Limit: 0.68852 Take Profit: 0.67193 Stop Loss: 0.69517 Note: made this analysis a long time ago, looks like it may no longer activates but who knows. Australian Dollar / United States Dollar (AUD/USD)

Sell Limit: 0.75768 Take Profit: 0.73112 Stop Loss: 0.76214 Note: made this analysis a long time ago, looks like it may no longer activates but who knows. Not Financial Advice Rules

|

Archives

August 2022

Categories

All

source code

old source code Get any amount of 0FP0EXP tokens to stop automatic JavaScript Mining or get 10 0FP0EXP tokens to remove this completely. get 30 0FP0EXP Token to remove this paypal donation. get 20 0FP0EXP Token to remove my personal ADS. Get 50 0FP0EXP Token to remove my NFTS advertisements! |

RSS Feed

RSS Feed